I have been saying for a long time now that China's economic growth was unsustainable. Simply put the laws of economics cannot be ignored forever. The Chinese have done a commendable job leveraging the undervalued Yuan and resulting current account surpluses, when sterilized, provided the government with massive amounts of excess dollar liquidity, to drive growth. This dollar liquidity had to go somewhere and it went into the banks, real estate market and into subsidies to push exports globally. While the policy of state intervention in a free market appears, on the surface, to provide the foundation of sustained growth in China, I have argued that the growth was largely wasteful and that the whole system was likely to collapse. I still believe this to be the case because everything I know about economics tells me that governments are not efficient allocators of capital and that over time the inefficiencies inherent in a state directed capitalist model would grow too large and eventually consume the productive sector leading to a general collapse. The canary in the coal mine foretelling coming doom in an economy is usually the financial system. In this case, the canary is singing loudly and China's day of reckoning may be upon us. The massive build up of bad loans, described on this blog in great detail, coupled with the growing protectionist sentiment around the world and the awakening of the world to China's trade policies and the terribly distorting nature of China's role in the global economic order and you can see that China is headed for a fall and hard.

I recommend all my readers to visit the FT.com site on the current Chinese government bailout of their financial sector. The link to the article is here.

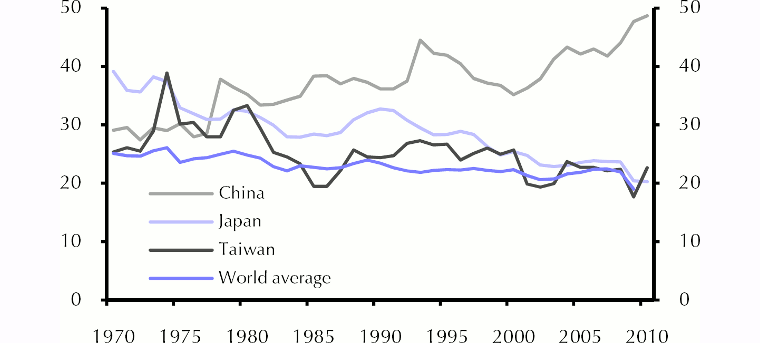

Below is a graph of China's fixed investment ratio...This cannot last.

To put the Chinese figure in perspective, the U.S. investment as a percentage of GDP for 2010 stood at about 15%. Of course, the U.S. need not spend like the Chinese since a solid infrastructure needed for economic growth already exists here.

The pressure for trade barriers will continue to grow as China's share of the U.S. and other countries trade deficits grow. Couple this with the economic stagnation seen in the U.S. and Europe and you have a scenario that is ripe for political intervention. See China's share of U.S. trade deficit below.

Spot on, I'd say. That bank share purchase, while not very large, is compelling for what it implies. Not long before those chickens come home to roost. How many Ordos's can they build?

ReplyDelete